2021 Options Benefits Changes

SEIU Local 721 Members: Pay close attention to your Options medical benefit plan changes for 2021.

- Beginning in January 2021 the negotiated County contribution toward the cost of your health care coverage will increase by 2.5%.

- As last year, there is a monthly cap on “cash back” that you can receive, however you can spend the surplus contribution on other Options benefits.

- Introduced in 2020, there is a lower-cost United Healthcare HMO plan option called Harmony.

Make sure that you understand all of your options before you make your benefit selections during the upcoming annual enrollment period.

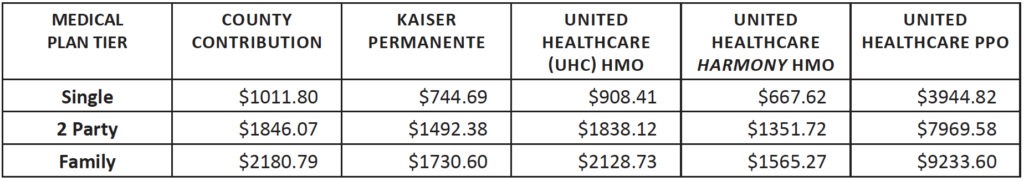

2021 Medical Premiums and County $ Contribution

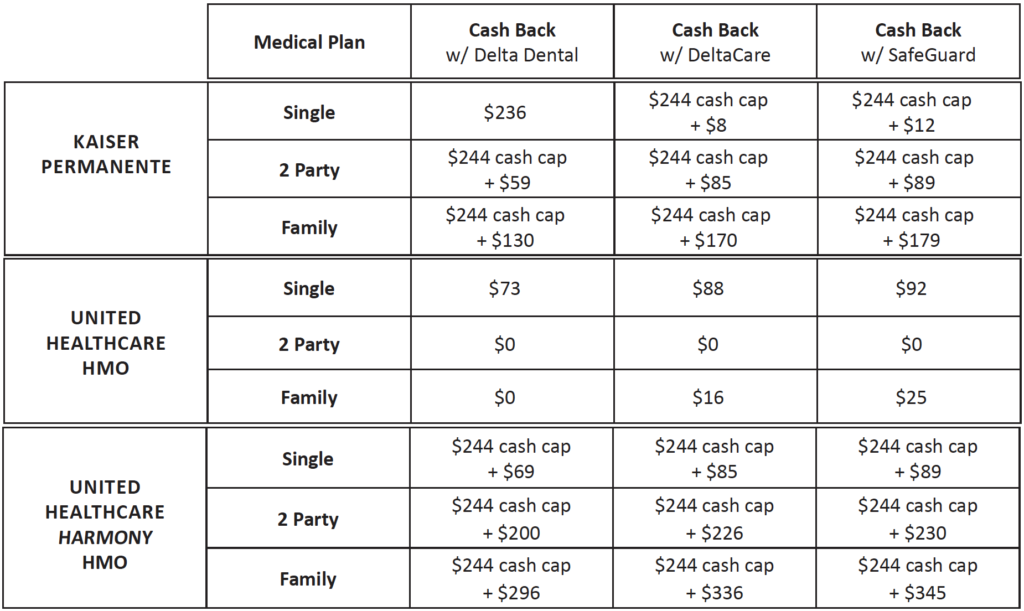

2021 Options Flexible Benefits Cash Back Comparison

What You Need to Know

If You’re a UNITED HEALTHCARE (UHC) Member

The UHC monthly premium will increase by 5.7% in January 2021. The County contribution will not increase enough to offset this increase, so “cash back” will be reduced for members with Single, 2-Party, and Family coverage. The County contribution will still be sufficient to fully cover the UHC premiums, but “cash back” (additional take home pay) will be reduced. However, since January 2020, SEIU 721 members have another UHC option – called Harmony – that provides maximum “cash back” and take-home pay. See below.

A Lower-Cost Option – United Healthcare – HARMONY

The UHC Harmony monthly premium will not increase for 2021, current rates will remain the same. The UHC Harmony network has been designed to offer medical providers that use a best-practice model that delivers quality care at a lower price. The Harmony HMO network of doctors, specialists and facilities is smaller than the regular UHC HMO, but the premiums are significantly lower. UHC Harmony members would receive the maximum $244 monthly “cash back” and have a surplus to “spend” on other benefits.

If You’re a KAISER PERMANENTE Member

The Kaiser monthly premium will increase by 6.4% in January 2021. The County contribution will not increase enough to offset this increase, so “cash back” will be reduced for members with Single, 2-Party, and Family coverage. However, most Kaiser members will still receive the maximum $244 monthly “cash back” and have a surplus to “spend” on other benefits. You do not have to lose your surplus health care contribution. You can put it in a health care spending account to cover co-pays and other medical expenses. Or use it to purchase optional life insurance or long-term disability health insurance.

Beginning in 2021, there will be a cap of $244/month on taxable cash back. Any surplus County contribution above $244/month will not be available as take home pay. But, you can maximize your benefit dollars, and avoid any loss, by spending the surplus on other Options benefits.

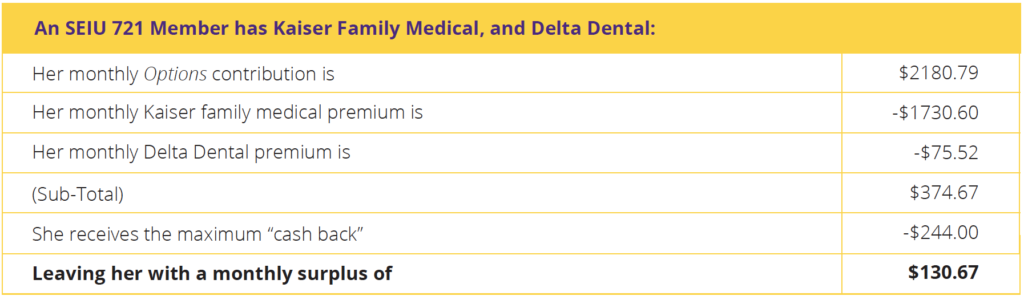

What Can She Spend the Surplus On?

Spending accounts

She can put surplus benefit dollars in a Health Care Spending Account to use pre-tax money to pay for eligible health care expenses, such as office visit copays, prescriptions, vision care, dental expenses, hearing aids, and certain over-the-counter medical supplies. If she has young children or elders, she can put surplus benefit dollars in a Dependent Care Spending Account to use to pay for eligible dependent care expenses, such as daycare centers, preschool, and adult daycare.

Optional group term life insurance

She can use the surplus to purchase up to 8 times her annual salary in optional life insurance. Each year she can increase her insurance benefit by one level. Additionally, if she has already purchased life insurance for herself, she can purchase dependent term life insurance for her spouse or domestic partner and dependent children.

Long-Term Disability (LTD) health insurance

If she’s in retirement plan A, B, C, D, E, or G and enrolled in an Options medical plan, she automatically gets 75% LTD health insurance coverage. Using her surplus, for $3/month she can increase to the 100% LTD health insurance level. This means her full medical plan premium would be covered while she’s on long-term disability.

Accidental Death & Dismemberment (AD&D) insurance

AD&D insurance provides benefits for paralysis, loss of life, limb, eyesight, hearing, or speech. If she has already purchased AD&D insurance for herself, she may use the surplus to purchase insurance for her spouse or domestic partner and dependent children.